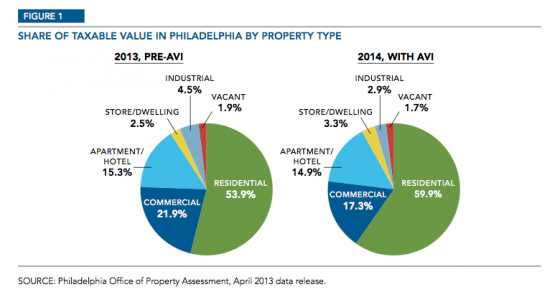

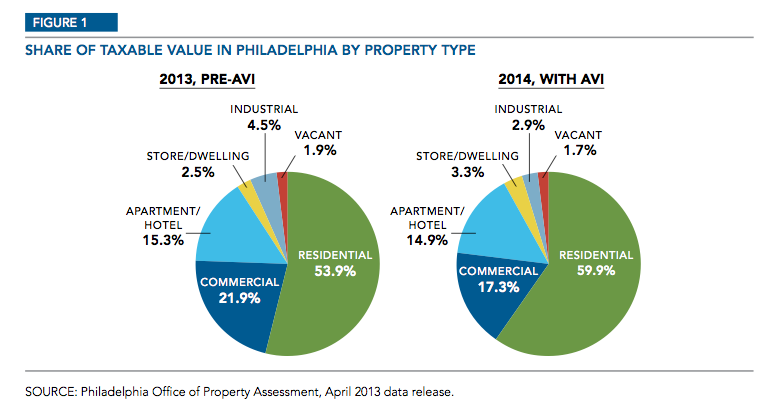

Yesterday, Pew Charitable Trusts issued a new report on the Actual Value Initiative (AVI), concretely expressing some outcomes of this policy that were already known or at least suspected by many. The primary takeaway from this report (which you can read in full here) is that AVI is shifting a portion of the property tax burden away from commercial owners and onto residential owners.

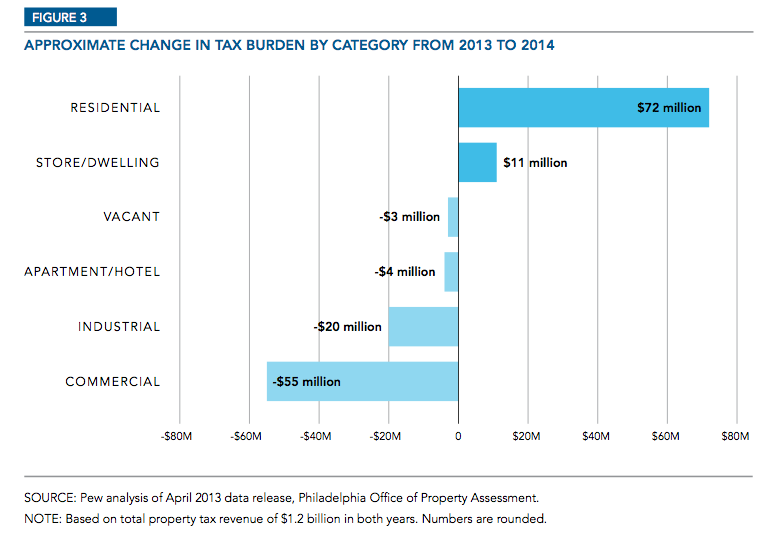

AVI has been pitched by the administration as a revenue neutral policy, and this is technically an accurate portrayal. But for homeowners as a group, AVI will not be revenue neutral, with an aggregate added tax bill of $72M. The report suggests that the reason for this change is that residential properties have generally been underassessed under the current system, while commercial properties have been assessed at values much closer to the “actual value” used to calculate property taxes under AVI. So the thought goes that homeowners have in fact been underpaying for years, with commercial property owners carrying a disproportionately large percentage of the burden. Anecdotally, it seems that many of the largest commercial properties have now been underassessed under AVI, which means the City could be needlessly pushing millions of dollars in tax responsibility onto residential properties. Something that would be good news for some and bad news for others- homestead exemptions would reduce the tax hike for residential properties and decrease the cut for commercial properties.

One other interesting takeaway from the report is the data that tax abated properties will see their property tax burden go down from $15M in 2013 to $12M in 2014. Again, the report suggests that this is because abated properties are already assessed at values closer to their actual value. We’d posit that it’s instead because of the irresponsible and inexplicable undervaluation of land in the neighborhoods where much of the residential new construction has taken place in the last decade. We would contend that if the land was valued properly, abated property owners would be seeing a small tax increase, rather than the decrease we see in the report.

Last week, the Controller’s office released a lengthy and detailed examination of AVI. We’re still making our way through that report, and will bring some of those findings to your attention later in the week.